Corporate Governance

Corporate Philosophy and Policy![]()

Medium-term Management Plan 2023![]()

Basic Policy on Corporate Governance Mar. 22, 2024 (297KB)![]()

Corporate Governance Report Apr. 3, 2025 (931KB)![]()

- Overview of Corporate Governance Structure and Reasons for Adopting This Structure

- Risk Management System

- Overview of Corporate Governance Structure

- Internal Structure for the Timely Disclosure of Corporate Information

- Status to the Corporate Governance Code

- Evaluation of the Board of Directors’ Effectiveness

Basic Views on Corporate Governance

The Oenon Group ("the Group") operates businesses based on biotechnologies derived from fermentation technologies in the Alcoholic Beverages, the Enzymes and Pharmaceuticals, and other fields, guided by its group corporate philosophy: "From the bounty of nature and with biotechnology as our base, we aim to help people find enjoyment and health through food."

The Group considers the provision of safe and secure products to customers its top priority. It conducts business activities in accordance with group-wide universal concepts-specifically, a focus on customers and a focus on profit-and concurrently pursues initiatives that contribute to "the co-creation of future value," while aiming to enhance the quality of its management and ultimately achieve sustainable growth and maximize corporate value for the Group over the medium to long term.

To enhance the quality of its management, achieve sustainable growth, and maximize corporate value, the Group ensures transparency and fairness in decision-making processes related to management, and accordingly works to establish a corporate governance structure that promotes timely and decisive decision-making.

Overview of Corporate Governance Structure and Reasons for Adopting This Structure

- 1Corporate Governance Structure of the Company for Group-Wide Management

- (1)Overview of Corporate Governance Structure

The Group has adopted a pure holding company structure that clearly distinguishes between management oversight and execution functions, and established the following meeting bodies.- Medium-Term Management Strategy Committee

The Group in principle holds two meetings of the Medium-Term Management Strategy Committee per month with the aim of formulating its future strategic direction to achieve medium-term targets, outlining its ideal vision for the Group, and creating new corporate value. The Medium-Term Management Strategy Committee consists of the president & CEO of the Company, managers of the Corporate Planning Dept. and other separately nominated officers or employees of the Company or its group companies. The committee deliberates on topics such as medium-term management strategies and specific related policies. - Conference of Group Management

The Group holds the Conference of Group Management with the aim of building consensus across the group (held twice each year in each division). The Conference of Group Management consists of the president & CEO and directors of the Company, and separately nominated directors, officers, or employees of group companies. The meetings deliberate on group-wide specific measures and topics related to sales, production, and management as applicable to each division. - CSR and Compliance Committee

The Group in principle holds two CSR and Compliance Committee meetings per year with the aim of supporting and providing guidance for effective implementation of CSR and compliance by all employees of the Company and its group companies. The CSR and Compliance Committee consists of the president & CEO and directors of the Company, and separately nominated directors, officers, or employees of group companies.

The committee deliberates on topics related to internal controls and compliance. - Nomination and Remuneration Committee

The Company ensures the independence, objectivity, and accountability of Board of Directors functions related to matters such as the selection of director candidates and director remuneration, by providing appropriate opportunities for engagement and advice to outside directors, and it has established a Nomination and Remuneration Committee as a voluntary advisory body of the Board of Directors to further strengthen corporate governance.

The Nomination and Remuneration Committee consists of four members (representative director and three independent directors) selected by a resolution of the Board of Directors.

- (2)Reasons for Adopting This Structure

The Group has adopted a pure holding company structure that clearly distinguishes between management oversight and execution functions to ensure transparency and fairness in decision-making processes related to management, and to accordingly support timely and decisive decision-making. The Group’s businesses are essentially supervised by individual companies operating under the group umbrella, and the main role of the Company—which is a holding company—is to formulate the broad direction for the Group in the form of a long-term vision, medium-term management plans, management policies, and other strategies, and monitor and supervise whether business execution at group companies is in line with this direction. In accordance with its Group Company Management Regulations, the Company supervises and supports the management of group companies, and aims to ensure consistency with the broad direction expressed in its long-term vision, medium-term management plans, management policies, and other strategies by engaging in advance deliberations with and receiving reports from group companies on important matters. - 2Governance Structure of the Company

- (1)Overview of Corporate Governance Structure

The Company has adopted a "company with an Auditing Group and external auditors" governance structure, and established the following meeting bodies.- Directors and Board of Directors

The Company has established the Board of Directors to exercise management oversight functions. The Board of Directors supervises the execution of duties by the representative director and responsible directors. As March 24, 2025, the Board of Directors consisted of six members, including three outside directors. The Company in principle holds one board meeting per month. The Board of Directors makes decisions on matters specified in laws and regulations, matters specified in the Company's articles of incorporation, matters delegated to the Board of Directors by a resolution of the general shareholder meeting, and other important matters related to management. Decision-making for other matters regarding business execution is delegated to the representative director and responsible directors. The representative director and responsible directors report the results of decision-making related to delegated matters and corresponding implementation conditions to the Board of Directors. - Auditors and Auditing Group

The Company has appointed auditors and established the Auditing Group to exercise management audit functions. All auditors conduct audits of the execution of duties by the representative director and responsible directors. As March 22, 2023, the Board of Directors consisted of three members, including two outside auditors. Auditors attend important meetings such as board meetings and the Conference of Group Management, express their views, and accordingly conduct audits of the execution of duties by the representative director and responsible directors. - Auditing Dept.

The Company has established the Auditing Dept. as an internal audit department that is independent from business execution functions. The Auditing Dept. reports information to auditors for every internal audit of group companies, conducts internal audits based on requests of auditors, constantly coordinates with auditors by holding meetings as necessary and through other means, and accordingly plays a role in strengthening the audit functions exercised by auditors. - External Auditor

The Company has appointed ERNST & YOUNG SHINNIHON LLC as its external auditor to exercise management audit functions.The Company has used Ernst & Young Shinnihon LLC as its external auditor for 53 consecutive years. This period indicates the scope of investigation; the actual auditing period may be longer than this period. Employees who execute audits are rotated appropriately. In principle, they do not contribute to auditing operations for more than seven consecutive fiscal years. Employees who lead the execution do not contribute to auditing operations more than five consecutive fiscal years.The external audit in FY 12/24 was conducted by certified public accountants Daisuke Ishida and Masatoshi Komiya, and assisted by 8 certified public accountants and 18 other personnel.

- (2)Reasons for Adopting This Structure

The Company has adopted a “company with an Auditing Group” governance structure to ensure transparency and fairness in decision-making processes related to management. This structure provides two layers of oversight in the form of oversight over business execution by directors and audits by individual auditors.

Three of the Company’s six directors are outside directors, and two of its three auditors are outside auditors. Based on their strong expertise and extensive experience in corporate legal affairs, corporate management, finance, accounting, and other fields, the outside directors and outside auditors provide effective advice and recommendations to ensure transparency and fairness of decision-making processes related to management from an objective and neutral standpoint, and exercise appropriate governance functions with regard to business execution functions. In addition, the Company aims to expand and enhance its governance functions through coordination between the Auditing Dept.-an internal audit department that is independent from business execution functions-and its auditors.

Risk Management System

In accordance with its Group Company Management Regulations, the Company regularly or as deemed appropriate reports on necessary matters, including internal information and—given its characteristics as a holding company— decisions on, or the emergence of, important matters at group companies expected to have an impact on the management, businesses, financial standing, operating performance, or other aspects of the Group. Its Corporate Planning Dept. supervises the management of information related to important policy decisions and other management information through the Conference of Group Management and dayto-day business activities. Information aggregated through the aforementioned reports and communication undergoes inspection, checks, or other forms of verification by the Corporate Planning Dept. relevant meeting sessions, and affiliated companies, and is subsequently reported to the officer in charge of information handling (manager of the Corporate Planning Dept.) and the representative director and president & CEO. Matters that require a decision by the Board of Directors or need to be reported at board meetings are presented to the Board of Directors. Furthermore, as necessary, the Company seeks the advice of outside experts with regard to appropriate checking and management of information.

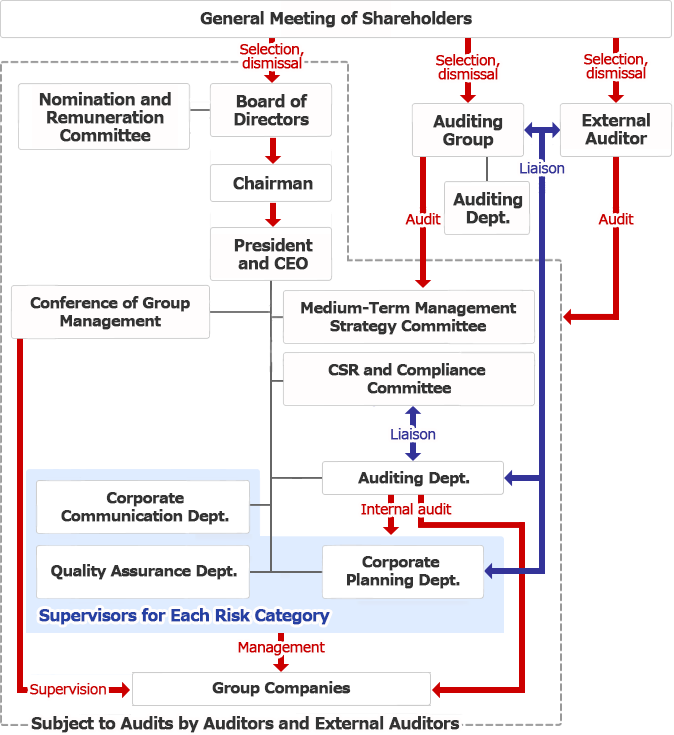

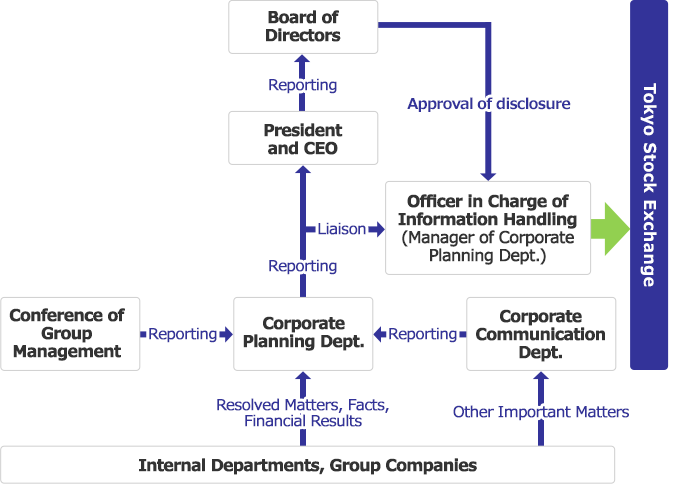

The figure below provides an overview of the Oenon Group’s corporate governance structure and Internal Structure for the Timely Disclosure of Corporate Information.

Overview of Corporate Governance Structure

Internal Structure for the Timely Disclosure of Corporate Information

Status to the Corporate Governance Code

Reasons for Non-compliance with the Principles of the Corporate Governance Code

<Disclosure based on the TCFD framework>

The Group has established an environmental policy and is actively engaged in initiatives to reduce environmental impact through its business activities, as well as to promote measures that have a positive impact on the environment.

The group's approach to environmental issues

Main Initiatives for FY2024

・Transition to green electricity.

・Compliance with the Fluorocarbon Emissions Control Act.

Greenhouse gas emissions reduction targets and progress

By FY 2030, the Oenon Group targets a 46% reduction in greenhouse gas emissions (compared with FY 2013), and we are working toward this goal. As of FY 2023, we had reduced emissions by 40%.

In fiscal 2025, we plan to implement a waste heat recovery system in our Enzymes and Pharmaceuticals Factory and work on measures to comply with the Fluorocarbon Emissions Control Act.

Disclosure Based on the Principles of the Corporate Governance Code

[Principle 1.4]

The Company strategically holds shares of other listed companies deemed necessary to maintain and strengthen trading relationships between the Group and business partners, and to achieve sustainable growth and improve corporate value for the Group over the medium to long term.

If the significance of holding certain shares has weakened, the Company gradually disposes of the holdings while taking into consideration conditions at the relevant companies.

Each year, the Board of Directors examines the purpose of its holdings by carefully reviewing their appropriateness and whether the associated benefits and risks are commensurate with cost of capital, and discloses the results of this review.

When exercising votes for cross-shareholdings, the company for each proposal confirms and reasonably determines factors such as whether the exercise will contribute to growth in group-wide corporate value over the medium to long term.

Basic Policy on Cross-Shareholdings![]()

[Principle 1.7]

When the Company engages in transactions with its officers, major shareholders, or other related parties, it obtains approval in advance from the Board of Directors-which includes independent directors-and reports to the Board of Directors after such transactions have been completed without delay.

[Supplementary Principle 2.4.1]

<Approach to Ensuring Diversity>

The Group recognizes that human resources with diverse perspectives based on differing values are indispensable for adapting to a highly uncertain business environment, achieving sustainable growth of the Group, and enhancing corporate value over the medium to long term. Based on this understanding, we will ensure diversity in the attributes of our core human resources by thoroughly conducting evaluations and appointments based on individual abilities without regard to attributes, and by promoting organizational development that makes the most of their characteristics and individuality.

In June 2020, we launched the "Project to Promote the Participation and Advancement of Women" and have been promoting initiatives to promote women's empowerment. At the Ordinary General Meeting of Shareholders held in March 2023, Project Leader Ms. Yukari Nakase was appointed the company's first female corporate auditor. At the Ordinary General Meeting of Shareholders held in March 2025, the current project leader, Ms. Naoko Tanaka, together with Ms. Reiko Oshika, who had been serving as the Company's outside auditor, were appointed as the Company's first female directors. Over the years ahead, we will continue to make efforts to develop core human resources that ensure diversity so as to promote the appointment of women and other core human resources to officers.

Views on Ensuring Diversity in Areas such as the Appointment of Core Human Resources![]()

<Voluntary and Measurable Targets for Ensuring Diversity, and Status of Ensuring Diversity>

- Women

The Group has set numerical targets and is actively promoting the appointment of women to management positions.

(Numerical targets) Women in management positions Now (2025): 12 Target: 15 Target date: 2028 - Mid-career hires

Employees hired mid-career account for 34.2% of management positions in the Group, and we recognize no differences in promotions timing due to the point in their career when people were hired. The Group has not set a target for the appointment of employees to management positions, as it is not in line with the gist of this policy. - Foreign nationals

The Group has no overseas locations and is developing its business only at locations within Japan. Accordingly, at this stage we have no plans to proactively hire foreign nationals.

<Human Resource Development Policies, Policies for Developing the Internal Environment, and Their Implementation Status>

- Human resource development policies

The Group recognizes the importance of building a system that ensures diversity in the attributes of the core human resources who support the directors, and that enables these core human resources to be promoted to directors as they gain experience. We promote understanding of the significance of diversity and develop core human resources who can make full use of the diversity of our employees through training courses that enable them to learn management skills that fully leverage diversity. - Policies for developing the internal environment

The Group recognizes that the realization of diverse work styles not only improves productivity and creativity, but also leads helps to secure diverse human resources. To secure a diverse range of human resources, the Group will develop an internal environment that facilitates diverse and flexible work styles.

[Principle 2.6]

The Group has introduced two types of corporate pension: defined benefit corporate pensions and defined contribution corporate pensions. The management of the funds of the defined benefit corporate pension plan is entrusted to an investment management institution with expertise and extensive experience, and the exercise of voting rights is also entrusted to the same institution, thereby avoiding conflicts of interest between the beneficiaries of the corporate pension plan and the Group. Given the size of the corporate pension plan, we have not appointed or assigned any specialist personnel, but we will work to fulfill our functions as an asset owner by monitoring investment institutions.

[Principle 3.1]

Corporate Philosophy and Policy

Medium-Term Management Plan 2028

Basic Policy on Determining Officer Remuneration![]()

The reasons behind the selection of director candidates are as presented in reference document "Proposal 2: Appointment of One Director" accompanying the Convocation Notice for the 117th General Meeting of Shareholders, and reference document "Proposal 2: Appointment of Five Directors" accompanying the Convocation Notice for the 118th General Meeting of Shareholders.

NOTICE OF THE 117TH ANNUAL GENERAL MEETING OF SHAREHOLDERS![]()

NOTICE OF THE 118TH ANNUAL GENERAL MEETING OF SHAREHOLDERS![]()

The reasons behind the selection of auditor candidates are as presented in reference document "Proposal 3: Appointment of Three Auditors" accompanying the Convocation Notice for the 116th General Meeting of Shareholders and "Proposal 3: Appointment of One Auditor" accompanying the Convocation Notice for the 118th General Meeting of Shareholders.

NOTICE OF THE 116TH ANNUAL GENERAL MEETING OF SHAREHOLDERS![]()

NOTICE OF THE 118TH ANNUAL GENERAL MEETING OF SHAREHOLDERS![]()

[Supplementary Principle 3.1.3]

<Initiatives for Addressing Issues Related to Sustainability>

The Group recognizes that meeting the expectations of society and building a relationship of trust with society are essential to achieving sustainable growth and enhancing the Group's corporate value over the medium to long term.In accordance with the Group's Corporate Group Philosophy, we maintain a combined customer- and profit-oriented focus as a universal Group concept and strive to ask ourselves "as a good corporate citizen, who do we serve and how do we serve them?" Through our business activities, we will fulfill our corporate social responsibility (CSR) by responding appropriately to issues surrounding sustainability (medium- to long-term sustainability, including ESG factors), and we will strive to contribute to the realization of a sustainable society and build a relationship of trust with society.

Issues Related to Sustainability (in Japanese)

<Investment in Human Capital, Intellectual Property, etc.>

The Oenon Group aims to be a company where each and every employee can enhance his or her abilities by providing a comfortable working environment with consideration for health and safety, and by realizing a working style that respects the diversity, personality, and individuality of employees.

Initiatives related to investment in human capital (in Japanese)

We recognize that investment in intellectual property is essential for strengthening our management foundation, and we are committed to the maintenance and management ofintellectual property rights through our research and development activities. Details of our principal research and development activities are disclosed in our securities reports. (Japanese only)

Annual securities report (in Japanese)

[Supplementary Principle 4.1.1]

The Board of Directors makes decisions on matters specified in laws and regulations, matters specified in the Company's articles of incorporation, matters delegated to the Board of Directors by a resolution of the general meeting of shareholders, and other important matters related to management. Decision-making for other matters regarding business execution is delegated to the representative director and responsible directors.

The Board of Directors receives reports on delegated matters and matters related to management from directors and group companies, and confirms operational decisions are consistent with the broad direction reflected in the Company's long-term vision, medium-term management plan, and management policies, and other plans.

[Principle 4.9]

The Board of Directors has established its own "Criteria Regarding the Independence of Outside Officers,"

Criteria Regarding the Independence of Outside Officers![]()

[Supplementary Principle 4.10.1]

To enhance fairness and transparency in the decision-making process for nominating candidates for directors (including succession planning for directors) and for the remuneration of directors, the Company has established the Nomination and Remuneration Committee under the Board of Directors. The committee, which is composed mostly of independent outside directors, provides appropriate involvement and advice to the Board of Directors, including from the viewpoint of diversity and skills. The Nomination and Remuneration Committee consists of three or more members (the majority of whom are independent outside directors) selected by resolution of the Board of Directors.

| Committee Corresponding to Nomination Committee | Committee Corresponding to Remuneration Committee | |

|---|---|---|

| Committee's Name | Nomination and Remuneration Committee | Nomination and Remuneration Committee |

| All Committee Members | 4 | 4 |

| Full-time Members | 0 | 0 |

| Inside Directors | 1 | 1 |

| Outside Directors | 3 | 3 |

| Outside Experts | 0 | 0 |

| Other | 0 | 0 |

| Chairperson | Outside director | Outside director |

[Supplementary Principle 4.11.1]

The Company ensures diversity in its Board of Directors by including directors with extensive experience in various fields such as group businesses, sales, production, and management, as well as independent directors who can exercise oversight of management from an independent and objective standpoint.

As per its Articles of Incorporation, the Company believes it is appropriate for the Board of Directors to have no more than 10 directors to facilitate timely and decisive decision-making, and that it is necessary to appoint at least two outside directors to support effective oversight of management from an independent and objective standpoint.

In light of its management strategy, the Board of Directors nominates individuals who possess the expertise, capabilities, high sense of ethics, fairness, and integrity required of directors as director candidates.

The proposal is subsequently submitted to the general meeting of shareholders for approval. In electing directors, the Nomination and Remuneration Committee, which is composed mainly of outside directors, deliberates on the draft prepared by the President and CEO, and the Board of Directors decides on the proposal, which is submitted to the General Meeting of Shareholders.

| Number of Directors | 6 |

|---|---|

| Number of Outside Directors | 3 |

| Number of Independent Directors | 3 |

| Positions | Independent Directors |

Name | Gender | Specialization and Experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management / management strategy |

sales marketing |

Manufacturing / production technology |

Research / development |

sustainability | Legal / risk management | finance / accounting / M&A |

IT / DX | ||||||

| President & CEO | Yuji Nishinaga | male | ● | ● | ● | ● | ● | ● | |||||

| Director | Hideaki Okada | male | ● | ● | ● | ● | |||||||

| Director | Naoko Tanaka | female | ● | ● | ● | ||||||||

| Outside Director | ● | Yukimasa Ozaki | male | ● | |||||||||

| Outside Director | ● | Tadao Saito | male | ● | ● | ||||||||

| Outside Director | ● | Reiko Oshika | female | ● | ● | ||||||||

[Supplementary Principle 4.11.2]

If its directors or auditors concurrently intend to serve as officers at other listed companies (in director, auditor, or executive positions), the Company requires that such activities are approved by the Board of Directors to ensure the relevant directors and auditors can devote sufficient time and effort required to appropriately fulfill their respective roles and responsibilities at the Company.

The status of important concurrent positions of directors and auditors is disclosed in the reference documents, business reports, or other materials accompanying convocation notices.

NOTICE OF THE 118TH ANNUAL GENERAL MEETING OF SHAREHOLDERS![]()

[Supplementary Principle 4.11.3]

The Company has decided to analyze and evaluate the effectiveness of all its Board of Directors functions each year by taking into consideration self-evaluations submitted by all directors and auditors as well as other information, and it discloses a summary of the corresponding results.

Evaluation of the Board of Directors’ Effectiveness

The Group also evaluates the effectiveness of the boards of directors at its four major subsidiaries.

The directors and auditors of all group companies complete self-evaluation surveys, and the effectiveness of the boards of directors of all group companies is evaluated based on the aggregated results.

In addition, summaries of evaluation results for each group company are reported by the group companies to the Board of Directors.

Based on these summaries, the Company has been able to confirm the effectiveness of the boards of directors of group companies in general terms.

Going forward, the Company will continue to perform regular evaluations of such effectiveness, and strive to further enhance the effectiveness of the boards of directors of major group companies.

[Supplementary Principle 4.14.2]

The Company's basic policy is to provide continual opportunities for directors and auditors to receive training required to appropriately fulfill their roles and responsibilities as a critical governance body of the Company.

[Principle 5.1]

The Company responds to the requests from shareholders to engage in dialogue as necessary and within a reasonable extent. The Board of Directors establishes policies concerning constructive dialogue with shareholders and strives to promote such dialogue.

Policy for Constructive Dialogue with Shareholders![]()

Evaluation of the Board of Directors’ Effectiveness

- 1Policy on Evaluating the Board of Directors’ Effectiveness

As described in Section 5 of the “Basic Policy on Corporate Governance,” each year the Company analyzes and evaluates the overall effectiveness of the Board of Directors, using the self-evaluations of each director and auditor as a reference, and discloses a summary of the results.

- 2Evaluation Method and Items

The questions (major items) in the 2024 questionnaire of all directors and auditors regarding the effectiveness of the Board of Directors, as well as their percentage of the total, are as follows.

- (1)Board of Directors Composition and Operation(28%)

- (2)Management strategy and business strategy(32%)

- (3)Business ethics and risk management(16%)

- (4)Monitoring of performance, and evaluation and remuneration of management(16%)

- (5)Dialogue with shareholders and others(8%)

- 3Evaluation Results

As positive opinions accounted for 92.5% of questionnaire responses, we evaluate that the effectiveness of the Board of Directors is sufficient.

- Items Receiving Relatively High Ratings

- (5)Dialogue with shareholders and others

The following points were positively evaluated:

・Active questioning and expression of opinions by outside directors, helping to foster productive discussion;

・Timely provision of information necessary for deliberation, such as industry trends;

・Appropriate oversight of the establishment and operation of internal controls and risk management systems;

・Proper feedback of opinions and other input gathered through dialogue with shareholders to the Board of Directors.

These were also reaffirmed as strengths that should be continuously maintained.

- Items Receiving Relatively Low Ratings

- (4)Monitoring of performance, and evaluation and remuneration of management

- 4Issues for the Future

Issues to be addressed to further improve the effectiveness of the Board of Directors are as follows.

・The need to examine the approach to orientation and training for directors;

・The lack of clarity regarding the role of the Board of Directors in formulating and executing human resources strategy;

・The need for concrete discussion on the succession planning for the President & CEO.

Based on the issues raised by the results of the evaluation and the suggestions and opinions of the directors and auditors, the Board of Directors will implement various measures to become more effective. In addition, to further improve the functions of the Board of Directors, we will continue to evaluate the effectiveness of the Board of Directors on an annual basis. - 5Evaluating the Overall Effectiveness of Boards of Directors of Group Companies

The Oenon Group evaluates the overall effectiveness of the Boards of Directors of its four main subsidiaries. Directors and auditors of each company complete self-assessment questionnaires. Each company evaluates its Board of Directors’ effectiveness according to the results of those questionnaires. In addition, a each company reports a summary of its evaluation results to Oenon’s Board of Directors.