Action to Implement Management that is Conscious of Cost of Capital and Stock Price

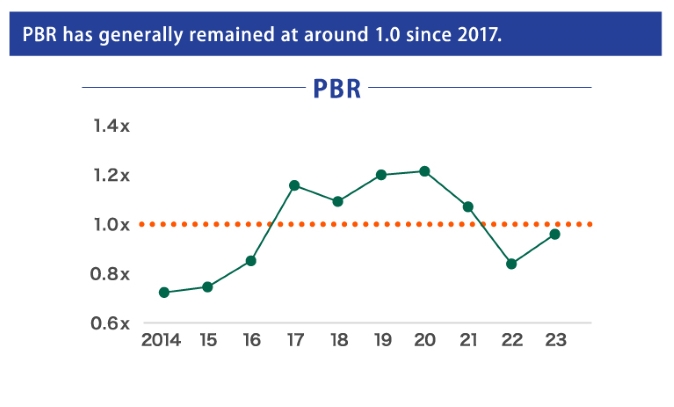

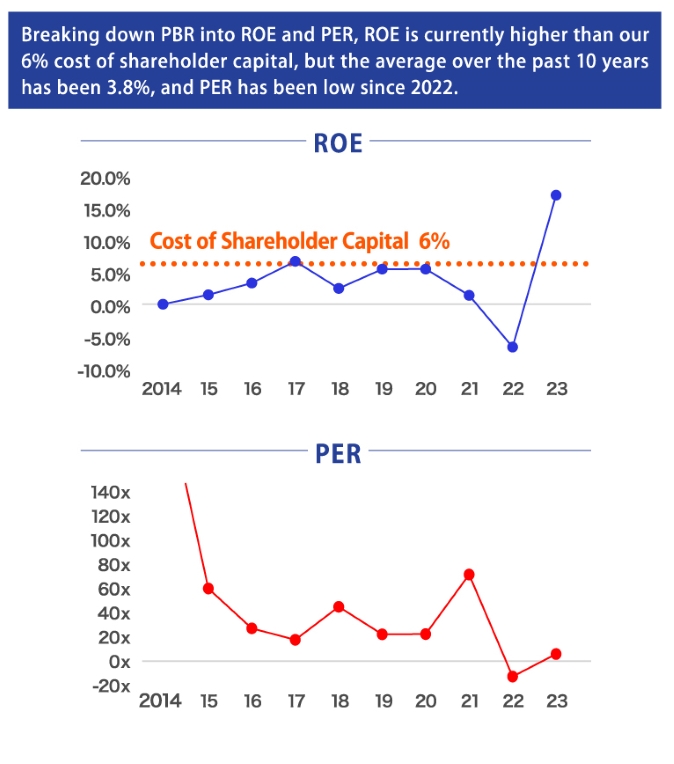

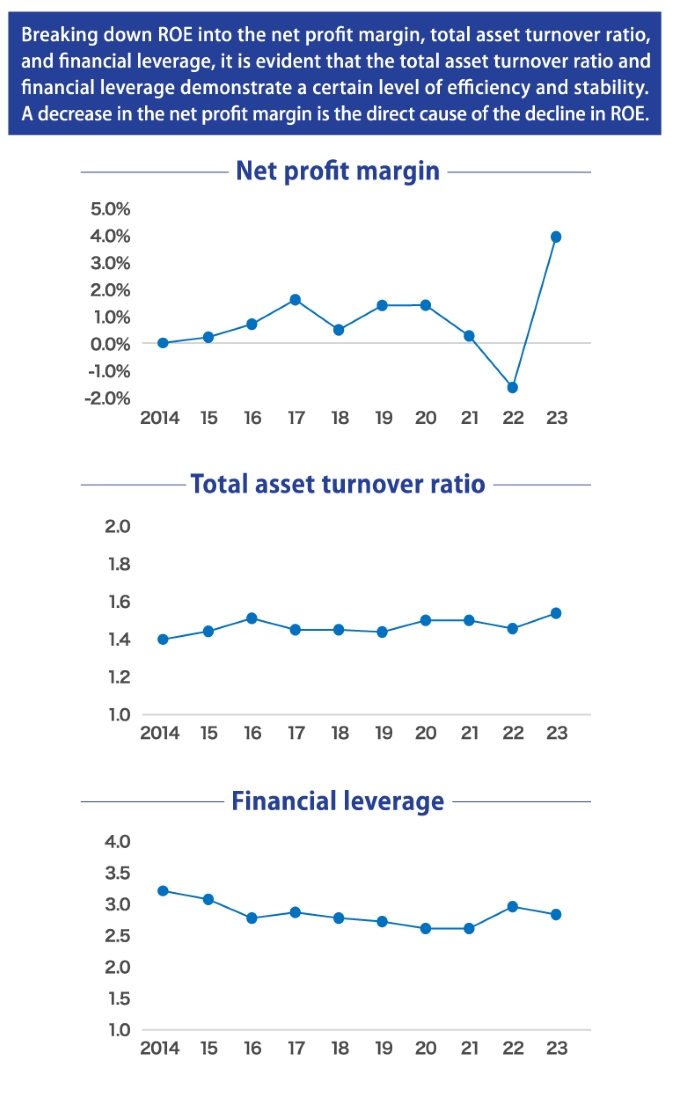

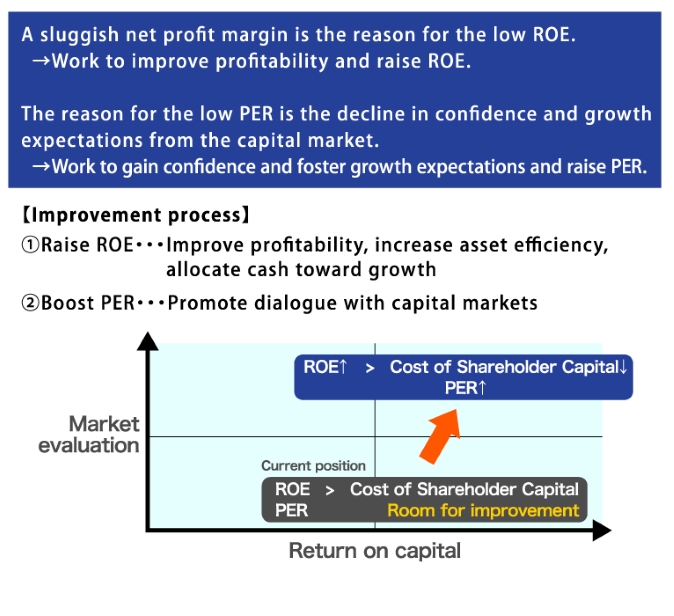

The price-book ratio (PBR) has generally remained around 1.0 since 2017. However, while in fiscal 2023 return on equity (ROE) exceeded the cost of shareholder capital that the Company assumes based on its capital asset pricing model (CAPM), average ROE over the past 10 years has remained at 3.8%, indicating that the factor behind the low ROE is the low net profit margin. Therefore, we need to focus on improving profitability.

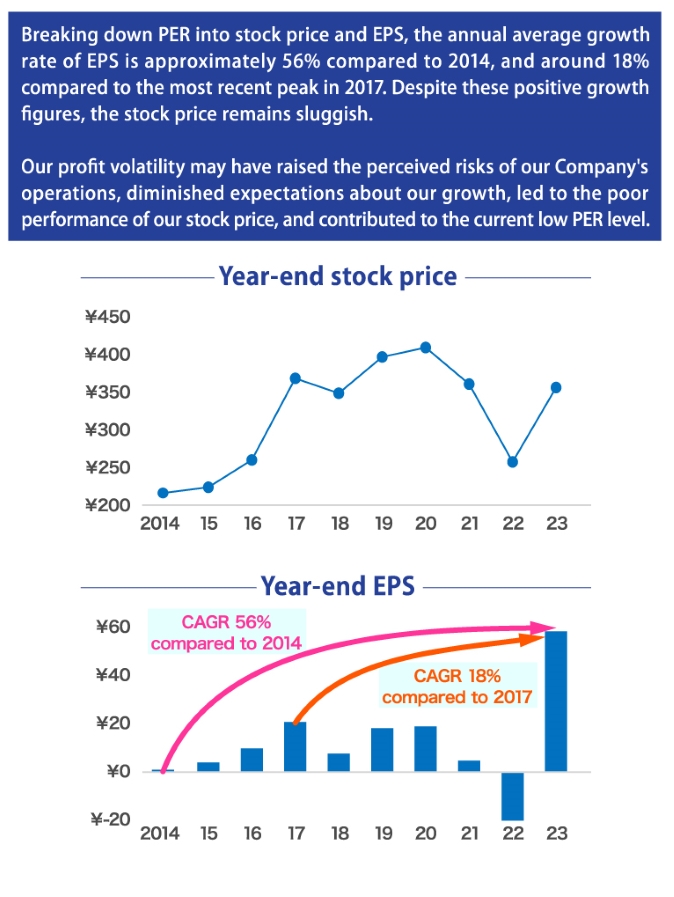

The price-earnings ratio (PER) has been weak since fiscal 2022. Profit growth has been sluggish since peaking in fiscal 2017, with a significant decrease in profit in fiscal 2021, a loss in fiscal 2022, and a substantial rise in profit in fiscal 2023. This volatility in profit has heightened the market's perception of risk and reduced expectations for growth, leading to a decline in stock price and resulting in the current low levels. Therefore, we must engage in dialogue with the capital markets to gain trust and foster expectations for growth, ultimately reducing the cost of shareholder capital and improving our stock price.

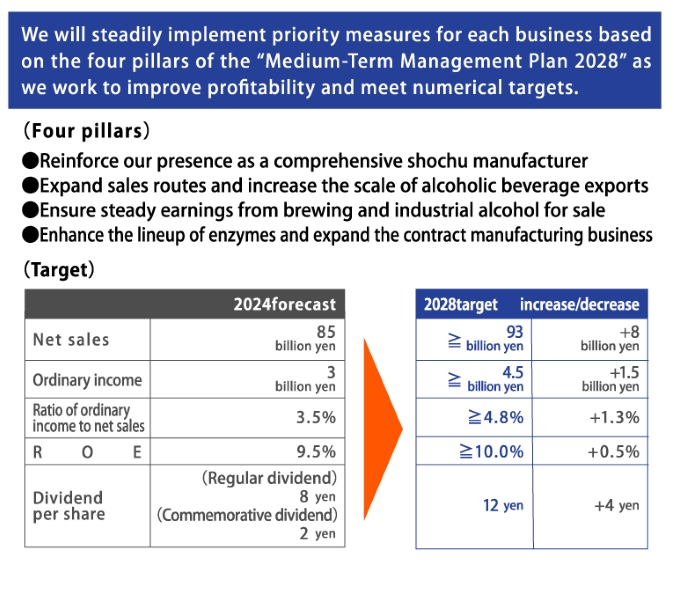

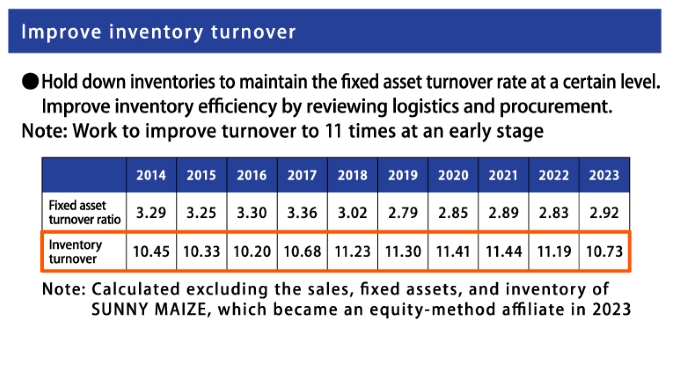

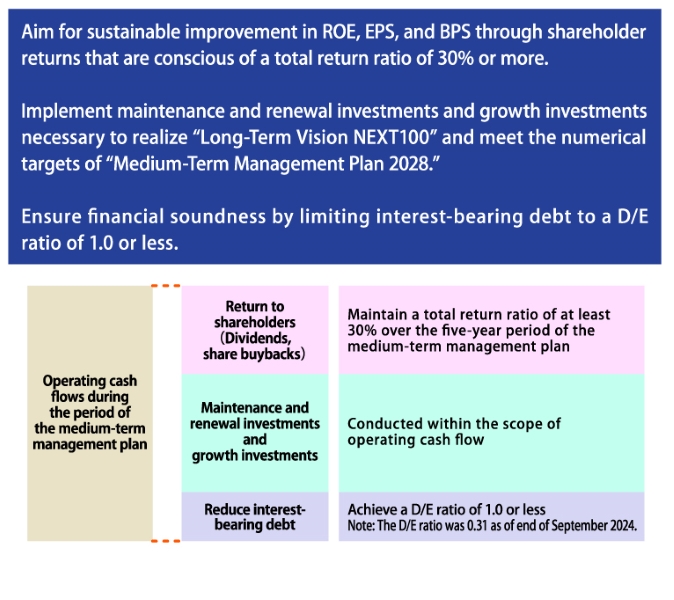

To meet the expectations of our stakeholders and achieve sustainable growth and the further enhancement of corporate value, we will continue to execute our "Long-Term Vision NEXT100" and "Medium-Term Management Plan 2028." These will include efforts to improve profitability, increase asset efficiency, allocate cash towards growth, and promote dialogue with capital markets in order to improve our PBR.

1. Analysis and Evaluation of Current Situation

2. Policies for Improving PBR

3. Initiatives to Improve PBR